If you are a freelancer, entrepreneur or independent worker, it is likely that your income is quite more variable than a permanent employee’s. Therefore, surely you need to keep a month to month control over your budget thus modifying it to avoid ending in red numbers or spending all the extra money you save.

At Workana we want your freelance lifestyle to be easiest as possible. That is why today we will talk about Mobile Apps that may help you lead an excellent control over expenditure, saving unnecessary walks to the bank and, in general terms, keeping much healthier finances.

Let’s check six digital financial tools that you should be already taking advantage of.

1. Banking Apps

Today, more than 73% of Malaysians are using Internet banking. This has prompted banks to modernise by introducing mobile applications and provide clients with a more practical and comfortable banking experience.

According to CompareHero.my 2017 Mobile Banking Apps Awards Winners, the two best mobile banking apps in Malaysia are:

Citibank MY

Citibank claims its application to enable to “keep you in control, virtually anytime, anywhere.” The app can be downloaded from the Apple App Store or Google Play Store. Its main features include:

- Online banking transactions. A Token enables you to authenticate all online banking transactions, as an alternative to other authentication methods like One-Time PIN (OTP) via SMS.

- Safe operations. Enhanced security, through a 6-digit PIN code restricted to only one mobile device, used to authenticate transactions or transfers above RM 10,000, requested for any payment. Touch ID-sensor provides secure login with just one touch.

- Instant access to account balance by setting up the Snapshot tool, without having to log in.

- Online payments. if you make online payments via CTI mobile App, you earn reward CTI points

- Overseas transactions and personal exchange rates set-up. It provides a fund transfers tool to make quick local or overseas transactions and it lets you set 24/7 your own exchange rates.

- Control over expenditure. Also, you may book time deposits, activate credit cards and set or reset ATM and credit card PINs, locate ATM branches and check transactions in real time to control expenditure more efficiently.

- Cash loans can be charged on your credit card. Eligible cardmembers have the additional benefit of taking cash loans on their credit cards to be repaid in monthly installments.

- Card lost locks. For those who are a bit inattentive it provides a fabulous tool: if you lose your card, with just one tap you can lock it to prevent misuse, and unlock it if you find it. Besides, you can enjoy offers and campaigns.

Maybank

Maybank mobile App has recently redesigned its application to provide a more refreshing banking experience. This app can be downloaded from the Google Play Store and be bound up in up to 3 devices. Among its main features, you have the following:

- All-in-one suite: The Maybank mobile App provides an all-in-one view of your accounts (current, Savings, Cards, Fixed Deposits, Loans and Wealth accounts).

- Fingerprint detection instant login: With just one tap, the app enables to log in, by checking your fingertips.

- Transfers: Transfers can be made to your account, and you have the possibility of setting favorite transfers to many recipients. Also, you may set up transfers via Western Union.

- Payments: You can make payments to anyone with an open transfer feature and make payments instantly just by scanning a QR code. You can also view bills and check your bills and payment history.

- Security: The app uses a Face ID and Voice ID biometric authentication method, which proves very safe. You can only log in to your Maybank2u account by using your facial points and voice pattern. Apart from this authentication features, you are requested to type your password to perform transactions.

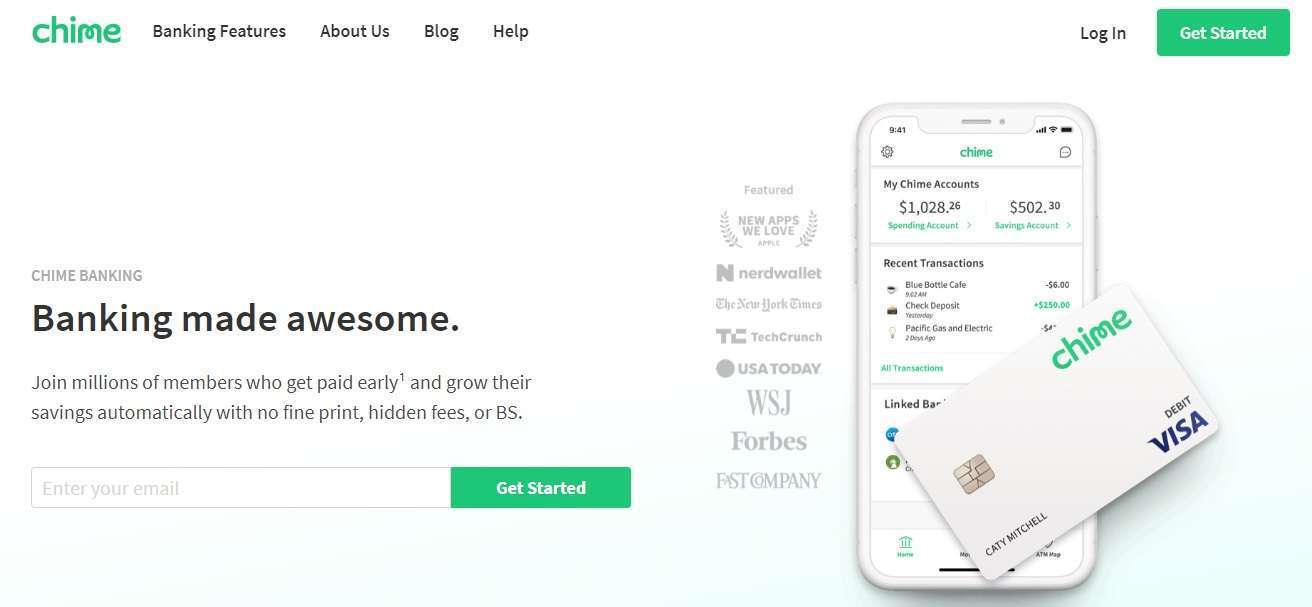

-

- Mobile Banking. Stay on top of your money. Chime’s banking app sends you daily bank account balance notifications and instant transaction alerts anytime you use your debit card.

- Get Paid Early. Get your paycheck early! That’s two more days to do more with your money. No waiting for your money while it sits in some mysterious electronic limbo, no paper checks lost in the mail.

- Automatic Savings. Chime makes it easy to automatically start saving money with every paycheck so you can achieve your financial goals faster. Chime members can automatically transfer 10% of every paycheck directly into their Savings Account.

- No Hidden Fees. No overdraft fees. No monthly maintenance fees. No monthly service fees. No minimum balance fees. No deposit required. No foreign transaction fees. The average household pays over $329 in banking fees each year, but not with Chime!

- Send Money Instantly. Send money instantly to friends using their mobile banking app. Great for splitting rent or divvying up other expenses.

- Mobile Check Deposit. Just snap a quick photo with Chime’s mobile banking app and watch your account balance grow. No more deposit slips, waiting in line, or sending checks via mail.

2- Mint

It is one of the best and most complete financial applications for independent workers, entrepreneurs, and freelancers. Moreover, it is ranked among the three best personal financial apps in the world, according to rockstarfinance.

According to the creators of the App statements, “life is good when it keeps finances under control.” Some of its best functionalities are:

- Synchronize bank accounts to know the amount at our disposal.

- Synchronize credit cards to know the amount of debt, interest rates included.

- Keep track of all your cash expenditures.

- List all your monthly financial obligations and set up reminders.

- It establishes financial goals for saving, debt payment, and budget allocations.

Yet, what makes Mint unique is the fact that being a smart App, in the long run, it “learns” based on your financial habits and starts providing tips, such as “this month, you could save a little more money” or “you are exceeding in your monthly restaurant expenditures’ pace”. It also gives a bit of positive reinforcement when you are doing well, with messages like “your August balance is going great!”

The main objection for Mint’s use is also security matters since we must provide access to our bank accounts. Nevertheless, according to an experts’ recent review, the App counts with a series of security padlocks that makes it as safe as banking Apps.

Mint is free, but in return, it collects users’ information to identify potential investors and roll out their client’s advertising. In truth, it is quite transparent. The only “but” that I would pose is that it is only available in English.

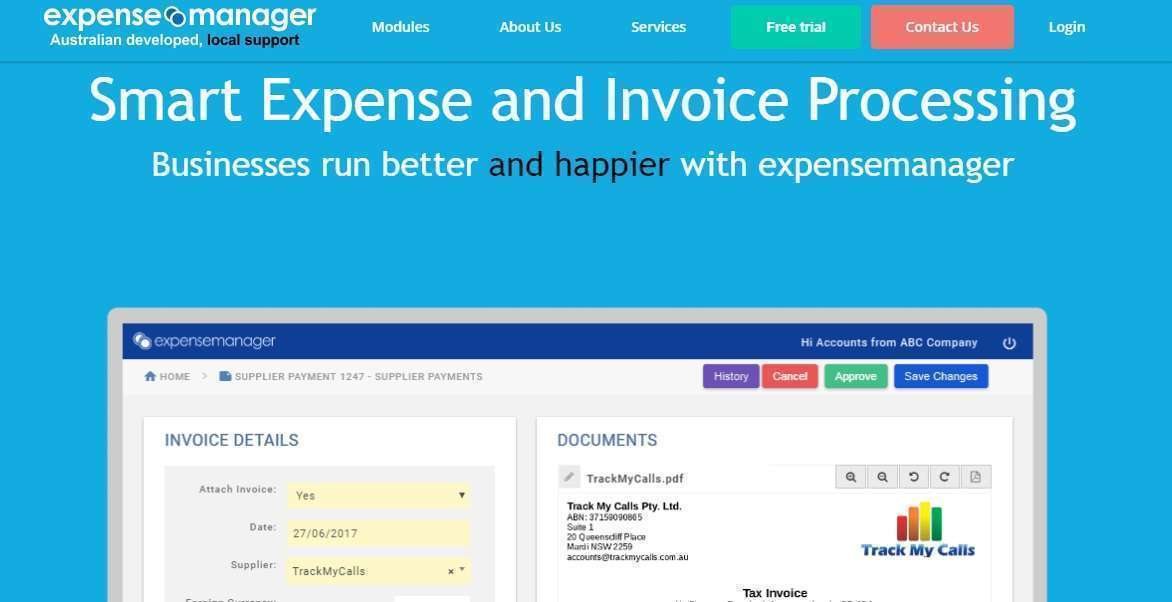

3- Expense Manager

According to Longstreet, among the five top apps to track your finances, you may choose the Expense Manager, a comprehensive money management app that will enable you to track fixed expenses, incomes, savings, and loans. Also, you may use it for planning expenditures in side projects. It provides video tutorials and finance tips, making it one of the friendliest applications in the world.

With free and premium features available, it allows you to export data to an Excel file, and load transactions using voice recognition. You also have the possibility of attaching pictures, receipts, and invoices to your documents. The app can be customised for local currencies, and it is available in all the countries throughout Southeast Asia.

4. – Daily Expenses: Spendee

If you have troubles to put your finances in order, John Lim recommends 5 fabulous applications you can use to put down expenses into categories accordingly, ranging from what you spend in chewing gums to what you pay in New Year’s dinner. These are Goodbudget Budget Planner, Spendee, Saved 3, Wally, and Fast Budget.

If you are the visual people kind who moves intuitively though icons, Spendee is one of the best choices. It is a very easy-to-use application with bright colours, graphs to check your spending habits and the possibility to customize your categories with matching icons. Therefore, you can check how much you have spent on each category, knowing the amount spent on petrol, cosmetic products, sweets, bills, groceries, and so on.

If you have troubles to put your finances in order, John Lim recommends 5 fabulous applications you can use to put down expenses into categories accordingly, ranging from what you spend in chewing gums to what you pay in New Year’s dinner. These are Goodbudget Budget Planner, Spendee, Saved 3, Wally, and Fast Budget.

If you are the visual people kind who moves intuitively though icons, Spendee is one of the best choices. It is a very easy-to-use application with bright colours, graphs to check your spending habits and the possibility to customize your categories with matching icons. Therefore, you can check how much you have spent on each category, knowing the amount spent on petrol, cosmetic products, sweets, bills, groceries, and so on.

Another practical issue is that you can compare your expenses and income by using charts during a timeline, thus identifying patterns to be changed in order to maintain finances healthy. It is important to point out that daily track serves little if you don’t have the discipline to put down every little expense you incurred.

Spendee has a free version that will not enable to synchronize your app with your bank account and share your wallet. However, for USD 22.99 a year you may enjoy a Premium Plan with all the functionalities available, including bank accounts synchronization, automatic categorization of your expenditures, and unlimited cash wallets and budgets. It is a single payment that entitles you to updates and additional functionalities; for me, it is well worth. You can try all the features in a 7-day free trial.

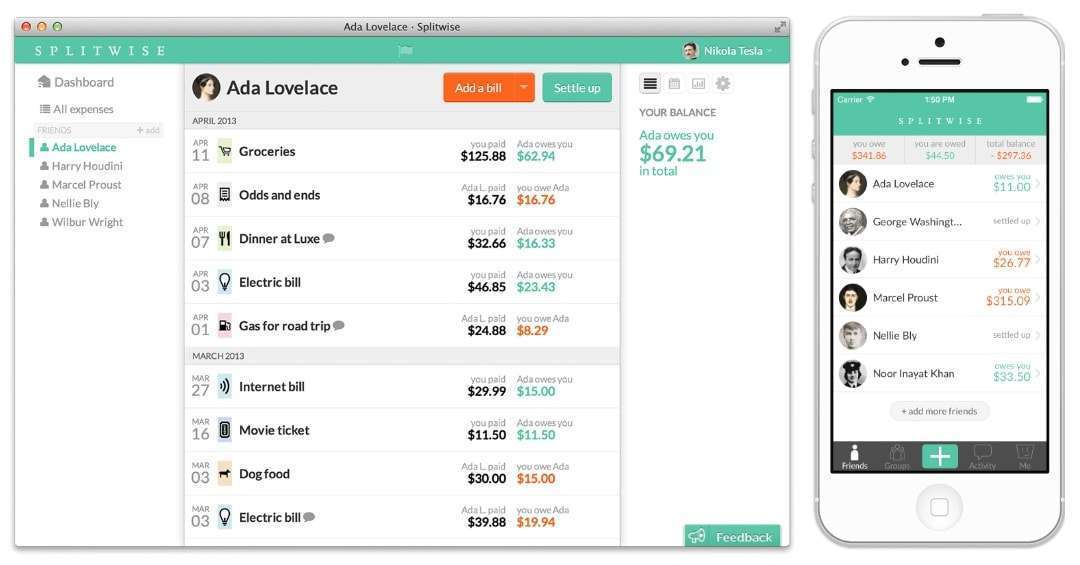

5. – Splitwise

This App is very handful for freelancers working in teams and sharing expenses such as workspace or co-working, bills or program licenses. It is also pretty efficient to share costs among friends or roomies, like dinner bills, storeroom or Netflix’s bills.

What I like most is that it is easy to use, bills cannot be more transparent, and it is designed to avoid unnecessary bill triangulations. As an example, if someone named A owes you $100, and you owe $100 to person B, the App provides an option for A to pay B $100 directly and keep peace among all.

Additionally, Splitwise avoids the nuisance of having to collect every little shared-expense. You can put down all the weekly or monthly expenses and gather them all together in one single expense report show.

Maybe the best of this App is the fact that it automatically sends reminders when someone forgets to deliver payments to you. Mostly, if you are the sort of people who have difficulties in collecting payments or feel embarrassed to claim, Splitwise can be quite a relief.

6. The spreadsheet: an old reliable tool

Even though I know it is not strictly an App, for me, Google drive sheets also seem an excellent complement to monitoring my daily financial issues.

Typically, I manage my schedule in one of these spreadsheets in the cloud because it allows me to check my pending tasks from any of my devices. I also put down how much I earned and how much I spent on each day. By doing this, I know all the time if my numbers are green or red and why.

Even though I combine banking and financial apps with an exhaustive registry in my Drive, if you are the kind of people unwilling to give sensitive information to an App, spreadsheets may prove a good alternative for you.

Nevertheless, keep in mind that times are changing and everything is modernised and that you can download the “app” kind version for your smartphone here.

Extra tip: Money Transfer Apps

Asia is the main remittance-receiving region in the world, according to a recent UN report.

For migrant freelancers, entrepreneurs or independent workers needing to transfer money to their country of origin or elsewhere there are excellent mobile apps thus avoiding expensive money transfer providers. With these tools, you can send money rapidly, using your smartphone and for a fraction of the cost that you would pay using traditional methods.

Among the top money transfer applications and remittance services in Asia ranked by Fintechnews, we may mention TransferWise, TransferGo, TNG Wallet, Abra, Coins.ph, and Toast.

- TransferGo’s, with headquarters in London, is a digital remittance solution targeted to migrant workers. It enables customers to transfer money to European countries and Hong Kong, the Philippines and India as well. By just registering in and providing the recipient’s details, you can make a local bank transfer or pay using a credit card. The money arrives within a few hours, and the transaction has a fixed transfer fee plus a currency conversion fee which may vary between 0,6 and 1,5% for currency conversion issues.

- Toast is based in Singapore, and it is a peer-to-peer money transfer app that enables Filipino migrants living in Hong Kong and Singapore to send money to their relatives and beloved ones directly, by just using a smartphone. According to Toast, this choice is 81% cheaper than traditional bank transfers, and money can arrive in just a couple of minutes. Senders have two transfer options available: pick up the cash at 7,000 locations at the disposal or directly to any bank.

- Another option is turning to international remittance services such as Valyou, which enables to send money overseas to over 2,000 locations using a mobile wallet app or via an Internet banking account. Depending on each country you may send the money directly to a bank account, send it to a cash-pick up agent or an e-wallet. Vietnam also has a home-delivery service available.

—

Undoubtedly, many of these 6 apps will make your freelance life friendlier, more manageable and tidy. Remember that each of them requires some time investment on your part, downloading it and learning to use it. However, considering all their benefits, it is a small investment well worth the effort.

According to your personal needs, you may combine all these tools to keep track of your expenditure, checking bills, receipts, money transfers, payments and enjoying the possibility of attaining much healthier finances and even saving some extra money.

At Workana, we want you to work comfortably and safe helping you to pursue your dreams by taking advantage of all these fantastic tools. Take into account that you can also use Workana’s platform, as the main channel to work with your clients, allowing you to keep a great record on your payments and deposits through the “My Finances” section, in which all your account’s inputs and outputs remain registered.